A Budget Case Scenario

Paul and Kate are recently married. Paul’s net pay per month is $2,000. Kate works part-time

and has a net income of $800 per month. Kate also receives $200 per month from a trust fund

set up by her family. The payments will end when Kate turns 30, which is in 3 years. Paul and

Kate are eager to buy their first house and have been evaluating their financial situation. They

have managed to save $6,000 but neither has begun saving for retirement. Their monthly bills

are as follows:

$750 Rent

$120 Utilities

$80 Car Insurance

$240 Food

$65 Cell phone

$40 Cable

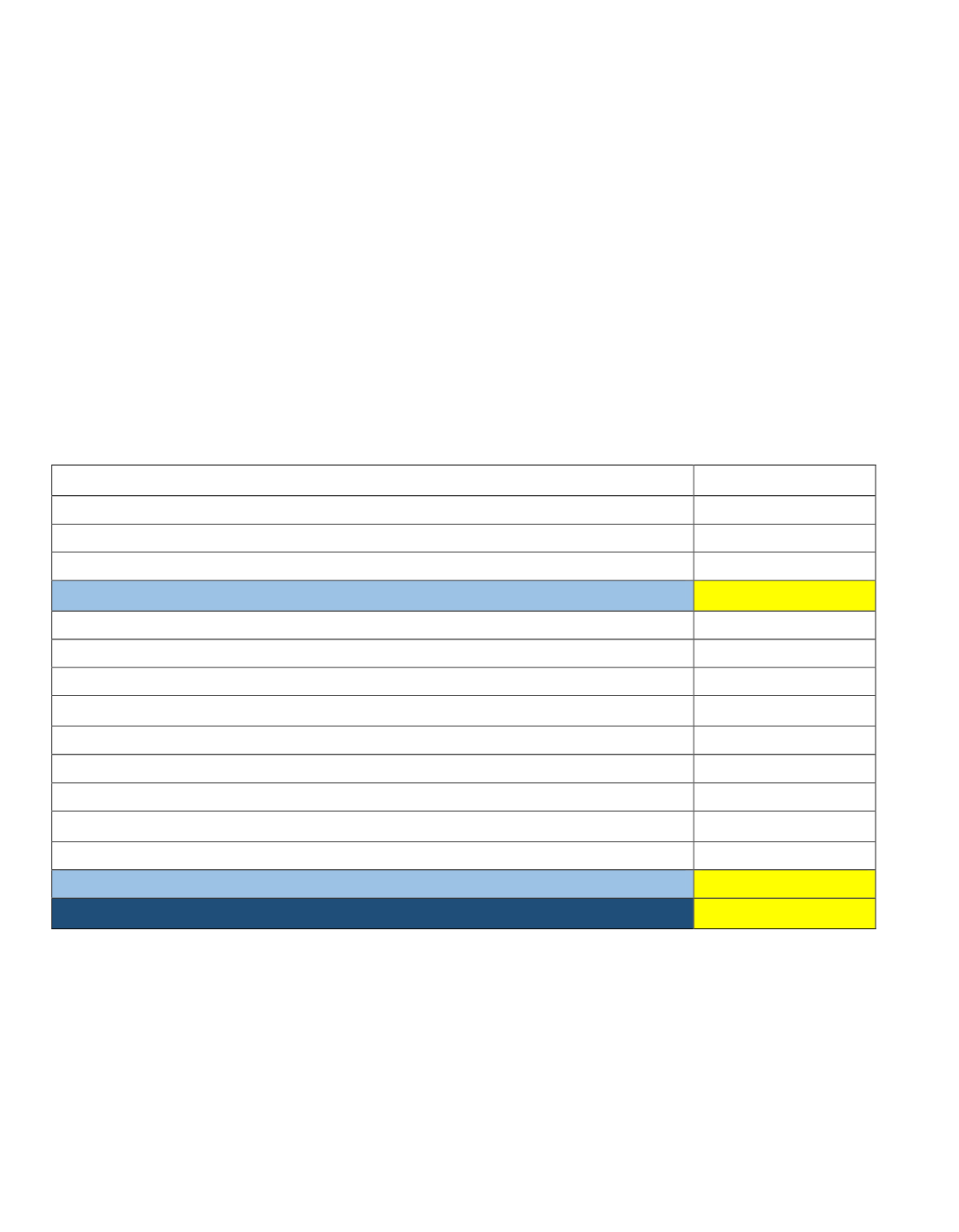

Using the income and expense information provided, populate the budget worksheet. Be sure

to save at least 10% for savings. When finished, answer the questions that follow.

Income Source

Total

Income Grand Total

Expense Source

Total

Expenses Grand Total

Income Grand Total – Expenses Grand Total

1. Based on the financial budget, should Paul and Kate buy the new house? Why or why not?

___________________________________________________________________________________

___________________________________________________________________________________

2. Looking at the expenses, what changes could the couple make to improve their financial

health?

___________________________________________________________________________________

___________________________________________________________________________________

$180 Health Insurance

$500 Childcare

$120 Gas and automobile maintenance

$200 Student Loans

$160 Credit cards

454

Section 18 – Planning For Your Future